.png)

INVEST IMPACT

Invest money to advance financial access to education and improve lives for millions of U.S. students.

Fund tomorrow's leaders today

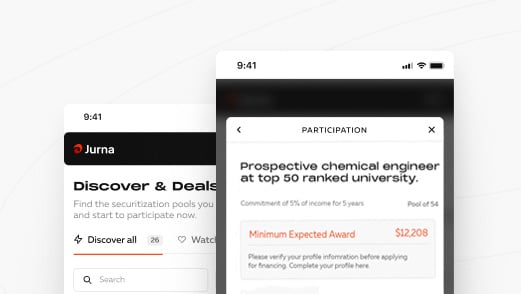

Jurna identifies groups of highly qualified students enrolled in specific academic programs who need education financing. Through its private marketplace, Jurna matches the financial needs of these students with the required returns of fixed-income investors.

This marketplace provides competitive pricing for students with similar earning potential. By providing industry resources and connecting students with employers, Jurna maximizes the economic value for both students and investors. Learn more about us.

$500k - $1M

The average expected funding pool for Jurna Scholars.

WHY INVEST IN EARNINGS-BACKED LOANS?

STATED RETURNS

Investors have the ability to select their desired return in an open marketplace.

RETURN PREMIUM

When students exceed their career prospects, both students and investors benefit.

INFLATION PARTICIPATION

Graduates working in competitive fields receive cost-of-living adjustments.

SOCIAL IMPACT

By providing students with affordable financing options, you're fueling the potential of the next generation.

-1.png)

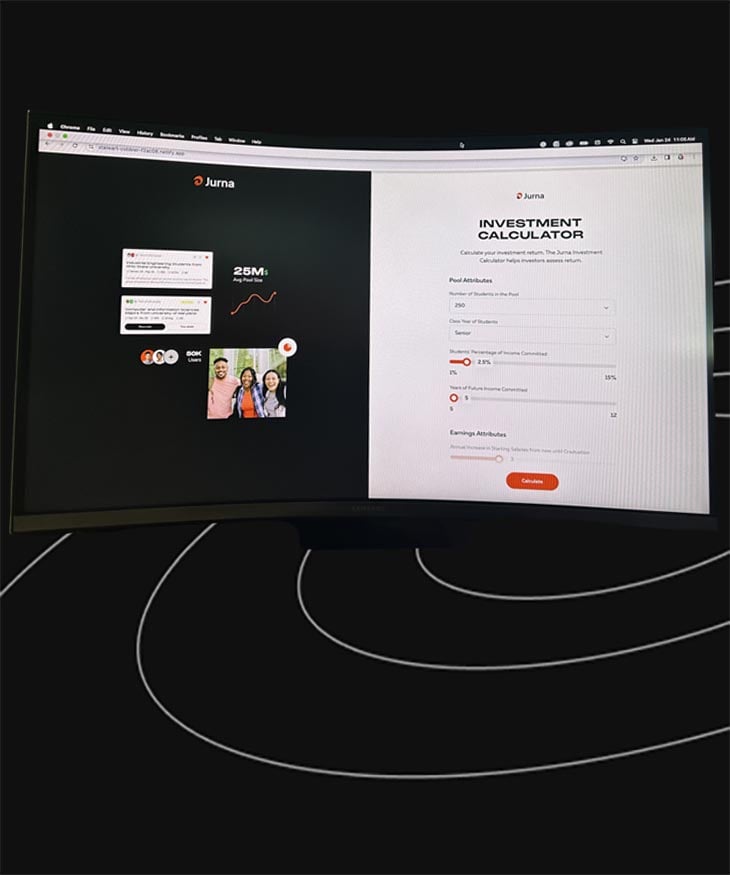

SMART INVESTING

The EBS calculator is designed to help you craft offers and assess expected returns. With simple inputs, you can quickly evaluate your potential investment returns.

Top Financial Minds Crafted Jurna

"I care about the financial security of everyday people. I’ve spent my career building industry-leading tools to help people provide for their futures. Jurna provides a new tool for students in a new time.”

Gus Sauter

Former CIO of Vanguard,

"We redefine how to finance education by creating a new liquid asset class linked to the value of the human capital that people accumulate through education."

Luigi Zingales

University of Chicago Booth Finance Professor

INVEST NOW

Join us in transforming student lending, get registered to be an earnings-backed financing investor.

How many pools of students do you anticipate this fund will provide for?

Over the initial course of three years with 1-2 pools of students, we anticipate 100 students in Year 1, 1000 students in Year 2, and 3000 students in Year 3.

What’s my expected return on this investment?

The fund will invest in many different loan pools for students with different majors and expected earnings. The expected return on these various pools will vary over time depending on the economic and interest rate environments. At the current time, the estimated average return is 8.5%.

How do you estimate the return that a pool will receive?

The pool’s return is an input into our pricing model. That input is used to determine the amount of funding a student will receive. The expected future cash flows from students’ payments are discounted at that expected return to arrive at the funding amount.

What is the risk that the investment in a given pool will not earn the expected rate of return?

The predictability of the return is based on the accuracy of our forecast of the cash flows from student payments. There are various factors that we’ve built into the model. We’ve based our cash flows on assumptions of students’ future earnings, future raises, and pauses in their payments for things like attending grad school and unemployment. Our net cash flow predictions are dependent on our ability to predict these various factors.

Will different pools have different expected returns?

If launched in the same economic and interest rate environments, they will have the same expected returns. The variance of the return will depend on our ability to predict the above stated factors among different types of students.

Is there a risk that certain high-performing students don’t participate because of concerns over subsidizing other students in the pool (i.e. selection bias)?

We mitigate this selection bias risk by defining the pools very precisely, focusing on narrow definitions of student majors and their schools.